us germany tax treaty summary

Both forms of tax are reduced by treaty relief. In general most situations are based on residency status - is the person a German resident or a US resident.

Irs Courseware Link Learn Taxes

PwC World Wide Tax Summaries WWTS helps external client users to get up-to-date summary of basic information about corporate tax and individual taxes in over 150 countries worldwide.

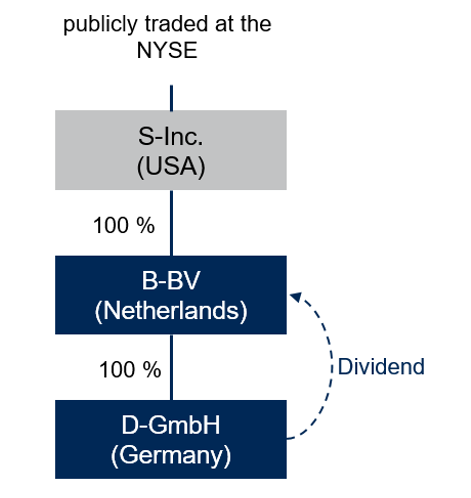

. Germany is effectively not permitted to tax on the basis of citizenship alone although it may tax a heir doneeor beneficiary domiciled in Germany receiving tangible property from a US citizen or domiciliary32 In the case of a US domiciliary who is also a Netherlands citizen Netherlands must give a full credit for US tax only if such. Where is the taxpayer working. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989.

1 4 DTC USA allows the USA to tax their own citizens regardless of the provisions of the DTC. This means that if you are a US NRA you would report the interest on your US tax return but then use the Foreign Tax Credit to reduce any taxes owed to zero. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The lower rates on dividends apply under certain conditions minimum shareholding specific shareholders in some cases minimum holding period.

Refer to the Tax Treaty Tables page for a summary of many types of income that may. It is divided into 16 provinces and its capital is Berlin. B There shall be allowed as a credit against German tax on income subject to the provisions of German tax law regarding credit for foreign tax the United States tax paid in accordance with the law of the United States and with the provisions of this Convention on the following items of income.

23 5 DTC USA. USCanada Tax Treaty Summary. Under Article 11 of the US-Germany tax treaty the US is not allowed to impose any tax on US-sourced interest earned by a German resident.

The complete texts of the following tax treaty documents are available in Adobe PDF format. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. The official language of Germany is German and the currency is the euro EUR.

Germany has the largest economy and is the second most populous nation after Russia in Europe. The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

A treaty between Germany and the United States helps clarify situations concerning which country any taxes must be paid to. As a result citizens and permanent residents of these two countries may have different tax return obligations based on their location. Under the treaty if a German decedent bequeaths the US.

In which country was income paid. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of German corporations for taxable years beginning on or after January 1 1991. The United States has tax treaties with a number of foreign countries.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. In most cases the US will credit the German tax against the US tax Art. Estate and Gift Tax Treaty or US.

Germany is a key member of the European economic political and defence organisations. This means that a US citizen who lives in Germany will be taxed in Germany because of tax residence and in the US because of citizenship. Property to his or her German surviving spouse 50 of the value of the property is excluded from US.

Germany - Tax Treaty Documents. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Estate and Gift Tax Treaty.

Refer to the United States Income Tax Treaties page for the complete texts of many of the tax treaties in force and their accompanying Technical Explanations. United States Income Tax Treaties - A to Z. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

Most importantly for German investors in the United States the Protocol would eliminate the. Estate and Gift Tax Treaty provides non-resident Germans. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

The proposed anti-abuse provision is uniquely tailored to. The saving clause Art. Both Canada and the US have established beneficial tax relationships with other nations to encourage commerce and reduce overall tax burdens.

Aa income from dividends within the meaning of. The Convention between the Federal Republic of Germany and the United States of America for the Avoidance of Double Taxation with respect to taxes on estates inheritances and gifts The Federal Republic of Germany and the United States of America the Treaty or Germany-US. Taxes on certain items of income they receive from sources within the United States.

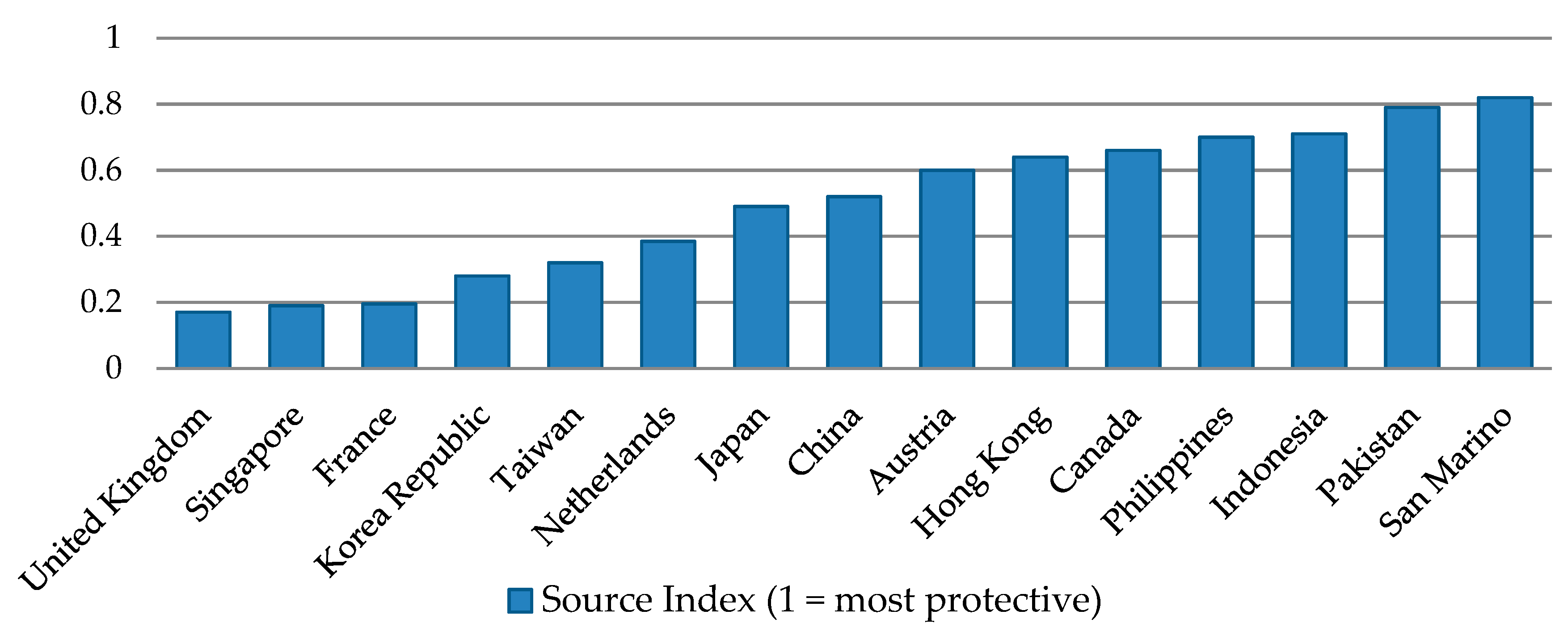

61 rows Summary of US tax treaty benefits.

Form 8833 Tax Treaties Understanding Your Us Tax Return

Should The United States Terminate Its Tax Treaty With Russia

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany Usa Double Taxation Treaty

Us Expat Taxes For Americans Living In Germany Bright Tax

What Is The U S Germany Income Tax Treaty Becker International Law

Pin On American History Powerpoint Presentations

Double Tax Treaties Experts For Expats

Doing Business In The United States Federal Tax Issues Pwc

Sweden Tax Treaty International Tax Treaties Compliance Freeman Law

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

The Us Uk Tax Treaty Explained H R Block

Should The United States Terminate Its Tax Treaty With Russia

Luxembourg Tax Treaty International Tax Treaties Compliance Freeman Law